- The Young Investor

- Posts

- It was all priced in

It was all priced in

What you should know about the markets

THE YOUNG INVESTOR

becoming a great investor one mistake a time

Welcome to This week’s edition of Market Bites

Grab a cup of coffee, get comfortable, and catch up on financial markets.

I’ve been doing the reading and scrolling, to bring you the most relevant updates.

Before we dive-in, take a look at:

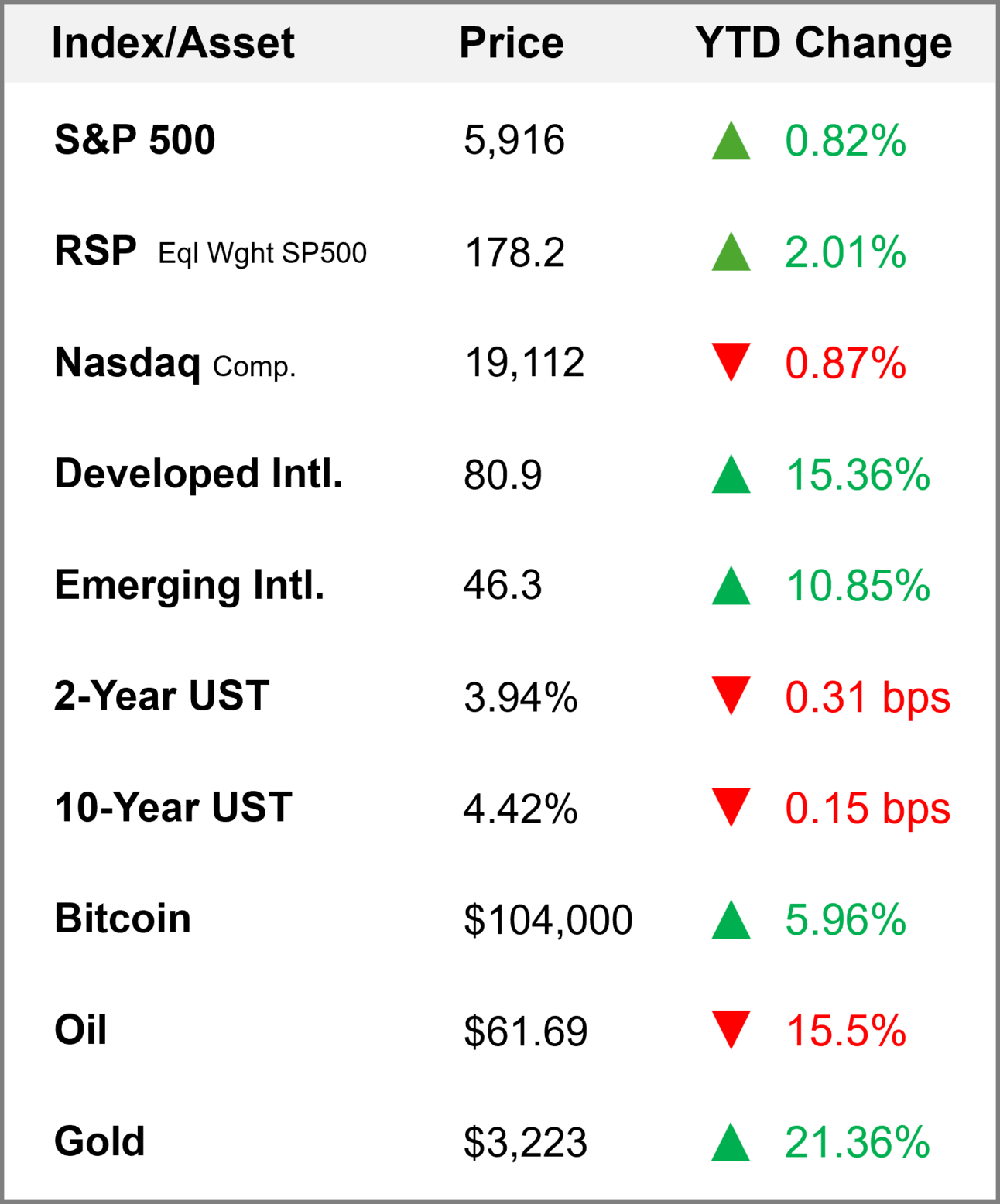

MARKETS YEAR-TO-DATE

Back in the Green

If you would have told me in the middle of the tariff panic in April that the US stock market would be positive YTD in one month later I would of said you were out of your f***ing mind.

I would of even bet money on it.

And yet here we are:

S&P 500 $SPX is now green on the year 📈📈

— Barchart (@Barchart)

2:50 AM • May 14, 2025

Crazier things have happened in financial markets, of course.

But, the fact is that we have seen one of the sharpest reversals in stock market history.

After a 22% rally from the April 7 lows, the S&P 500 is now up on the year. One of the biggest short-term comebacks in market history. $SPX

bilello.blog/newsletter

— Charlie Bilello (@charliebilello)

2:45 PM • May 13, 2025

Not just a any bounce.

1982.

The last time the S&P 500 erased a 15% YTD decline in under 6 weeks.— Bespoke (@bespokeinvest)

6:23 PM • May 13, 2025

I Waited, Trump Folded

I remember talking with multiple friends during the April mess, everyone trying to figure out what came next.

I genuinely thought markets were headed lower. And I was actually excited to deploy some dry powder I had.

I had the spreadsheet open, cash sitting, and a little part of me already patting myself on the back for the bargains I was gonna buy.

I’d even started to slowly deploy capital. Nothing aggressive, just dollar cost averaging into the major indexes.

And on one of the calls, a good friend was adamant:

“You’re too early. This isn’t done. You have to wait. Trust me.”

And honestly, I was sure he was right.

Everything felt like it was about to crack lower.

But just to play devil’s advocate, I floated the idea: “Look, maybe we’re wrong. Maybe Trump walks back the whole trade war.”

The response: “Nah, no chance. Not yet.”

And honestly, that made sense at the moment:

“These tariffs will remain in effect until such a time as President Trump determines that the threat posed by the trade deficit and underlying nonreciprocal treatment is satisfied, resolved, or mitigated.” —White House Fact Sheet, April 2, 2025

“The president has reiterated that there will be no exemptions or exceptions in the short term.” —Trade Rep Jamieson Greer, April 8, 2025 (Reuters)

So yeah, it didn’t look like a bluff.

And then… Trump folded.

Slowly. Then completely. 🫠

“145% is very high… It won’t be anywhere near that high. It’ll come down substantially.” —Trump, April 22, 2025

“We’ve completed a full reset with China… the relationship is very good.” —Trump, May 12, 2025

“Tariffs on China won’t return to 145%—even if no deal is reached.” —Trump May 12, 2025

Which goes to show, again, how hard it is to forecast what happens next.

Even the fund manager professionals were left waiting:

BREAKING 🚨: Fund Managers

Fund Managers have missed out on the recent stock surge after recently reducing their equity exposure to the lowest levels in 2 years 👀 Rekt!

— Barchart (@Barchart)

9:33 PM • May 13, 2025

And honestly? That’s the lesson.

This was the perfect example of why trying to get too cute with market timing sucks.

If prices are falling and you’ve got a long runway, you keep dollar cost averaging. Period.

The moment you start thinking you can nail the bottom or outsmart the market, you’re probably cooked.

So yeah, what a curve-ball.

The lingering question : Is that it then, is the trade war over?

That’s what markets are telling you.

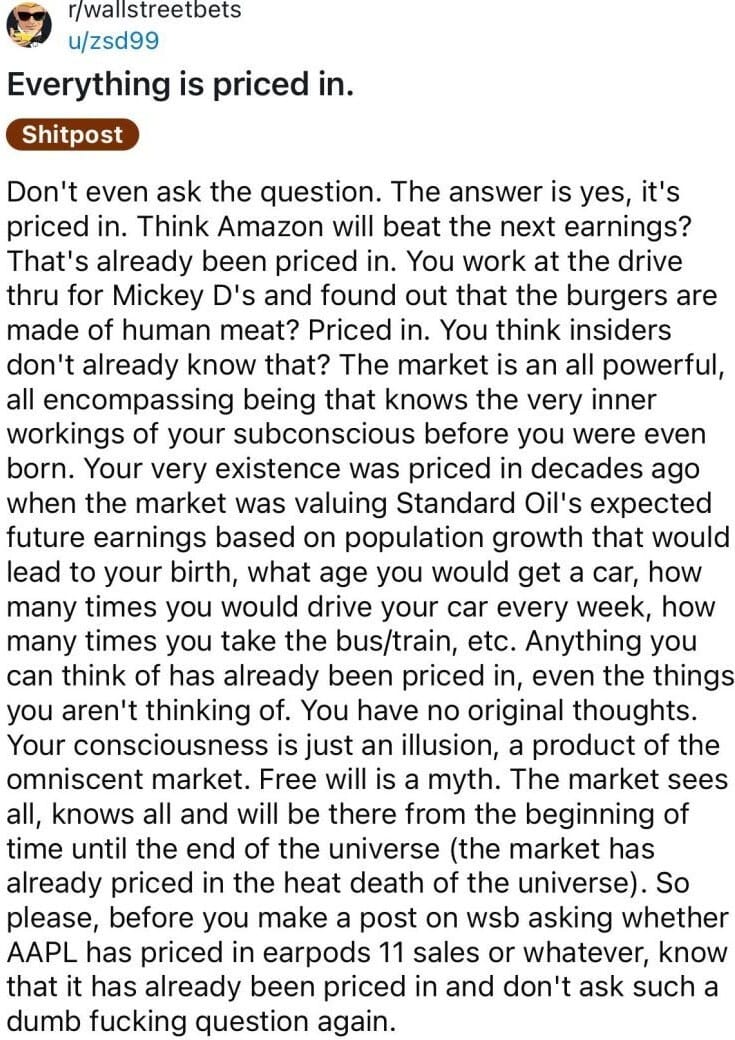

As one of the greatest posts in Reddit history said best “Everything is Priced in” 🤣

Ask and You Shall Receive

Last week I wrote about how Saudi Arabia, along with the UAE, was helping engineer a drop in oil prices. A clear win for Trump, who wants to look like a winner in the fight against inflation.

The question was: What was Saudi going to receive in return?

Turns out, a lot of goodies.

#Breaking: US grants Saudi access to Nvidia's advanced chips despite prior restrictions. $NVDA CEO Huang showcased Blackwell racks for HUMAIN, a new AI firm under Saudi's sovereign wealth fund.

Major policy shift for regulated tech.

— Kristina Partsinevelos (@KristinaParts)

1:00 PM • May 13, 2025

What exactly was the deal:

Saudi Arabia:

Struck a $600B U.S. partnership, with $20B for AI data centers and major investments from Google, Oracle, and NVIDIA 💸

Google Cloud and Saudi’s Humain are launching an AI hub in Dammam.

NVIDIA is supplying 18,000 top-tier AI chips to Saudi Arabia.

Multiple deals with U.S. tech firms to boost AI, cloud, and cybersecurity.

UAE:

Secured U.S. approval to import up to 500,000 Nvidia AI chips per year.

Building the world’s largest AI campus outside the U.S. in Abu Dhabi, run by U.S. firms.

UAE will match these investments with U.S. data center projects.

In both cases: Agreed to strict U.S. oversight to prevent tech transfer to China.

So why does this matter for the broader stock market 📈

“The Trump administration just rescinded Biden-era export controls on where Nvidia can send its AI chips around the world.

This is the second largest company on the planet, the market share leader in the world's most critical growth story and, in my opinion, now the most important individual stock chart as well.

Bears would be hoping for a head and shoulders top here to crush everyone's spirit.

But if the Bulls get a breakout above previous resistance at $150, it's going to be a party like the Rebel Alliance just knocked out a Death Star over Endor. We're talking Diddy levels of stock market lasciviousness.

Put this on your screen and set an alert for the 149.00 level...you're gonna want to watch if and when she gets there.”

This isn’t just a chip story, it’s a geopolitics + growth + sentiment trifecta.

While everyone is distracted with something else, Saudi and UAE quietly bought a seat at the center of the next economic regime. Opening the way for them to become major AI hubs.

With Washington’s blessing.

And in return, the U.S. is gaining:

A pressure release valve for domestic AI infrastructure bottlenecks

Guaranteed demand for strategic tech exports

And stronger geopolitical alignment in a region China’s been courting aggressively

INTERESTING CHARTS of the week

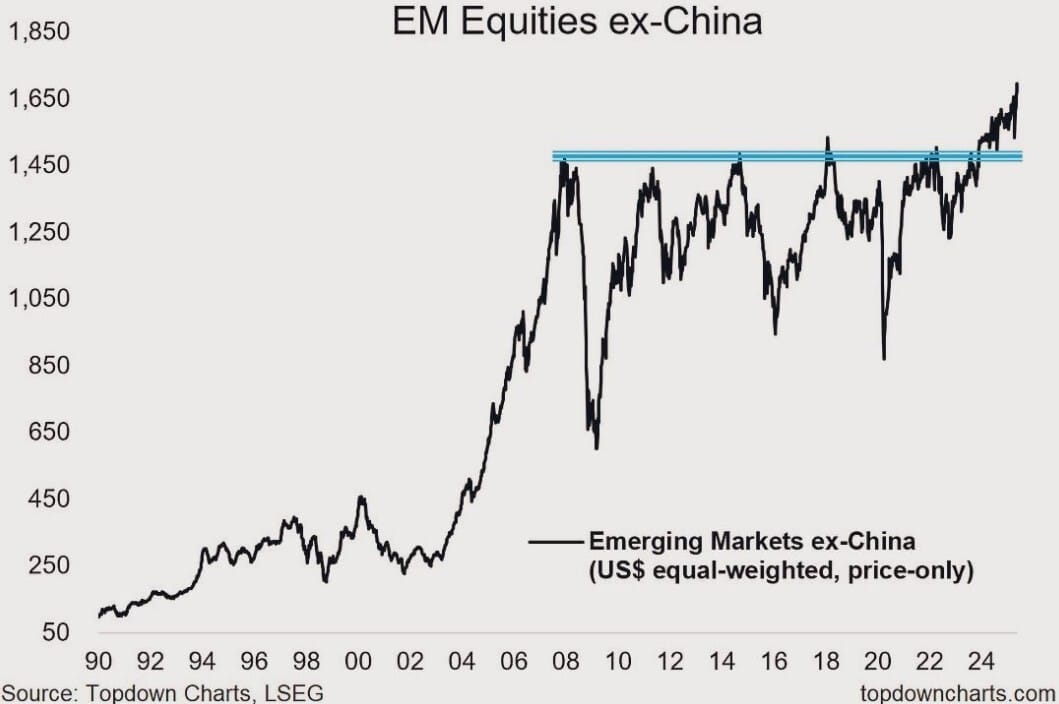

One of the most important charts nobody is talking about.

Emerging Market equities (excluding China) continues breakout to new highs. After 16+ years stuck in the same trading range.

These stocks and countries have been left for dead by equity investors.

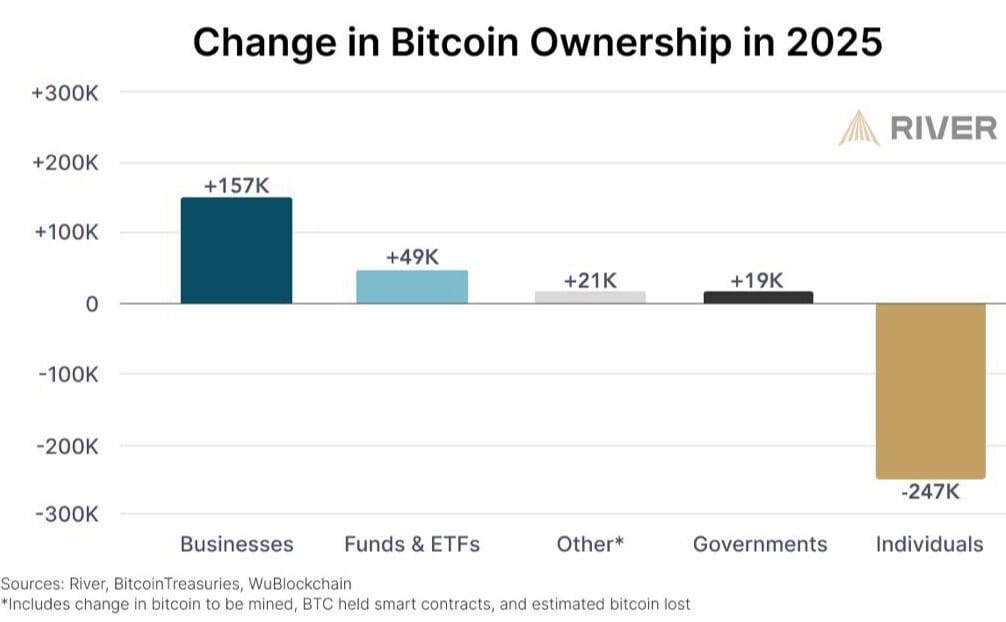

Bitcoin ownership continues to grow outside of the retail investor crowd:

PARTING WISDOM

thanks for reading and have a great weekend,

Al Atencio

Receive the next article by subscribing below 👇🦉