- The Young Investor

- Posts

- The End of U.S. Stock Market Dominance?

The End of U.S. Stock Market Dominance?

What you should know about the markets

THE YOUNG INVESTOR

becoming a great investor one mistake a time

Welcome to This week’s edition of Market Bites

Grab a cup of coffee, get comfortable, and catch up on financial markets.

I’ve been doing the reading and scrolling, to bring you the most relevant updates.

Before we dive-in, take a look at:

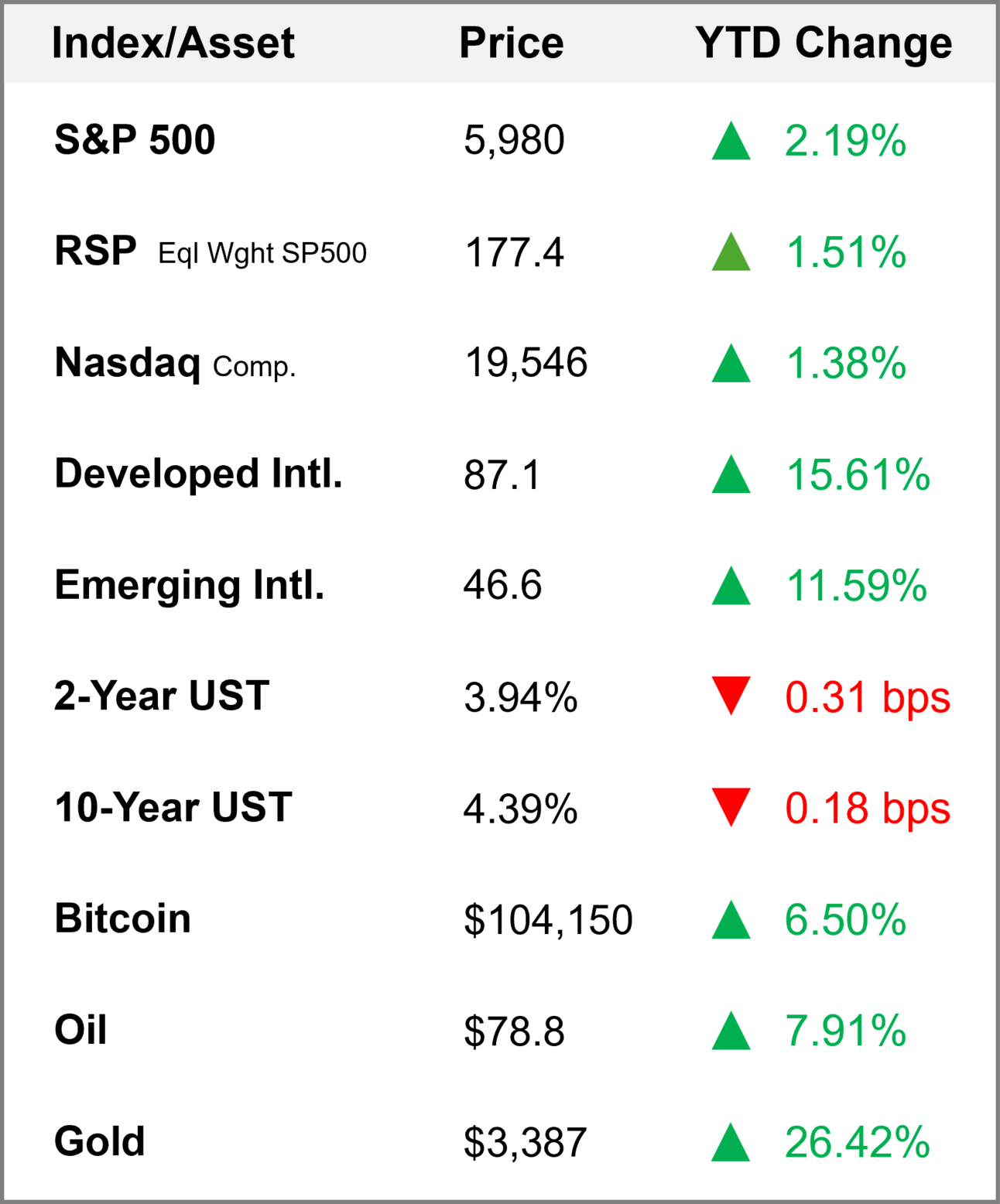

MARKETS YEAR-TO-DATE

The End of U.S. Stock Market Dominance?

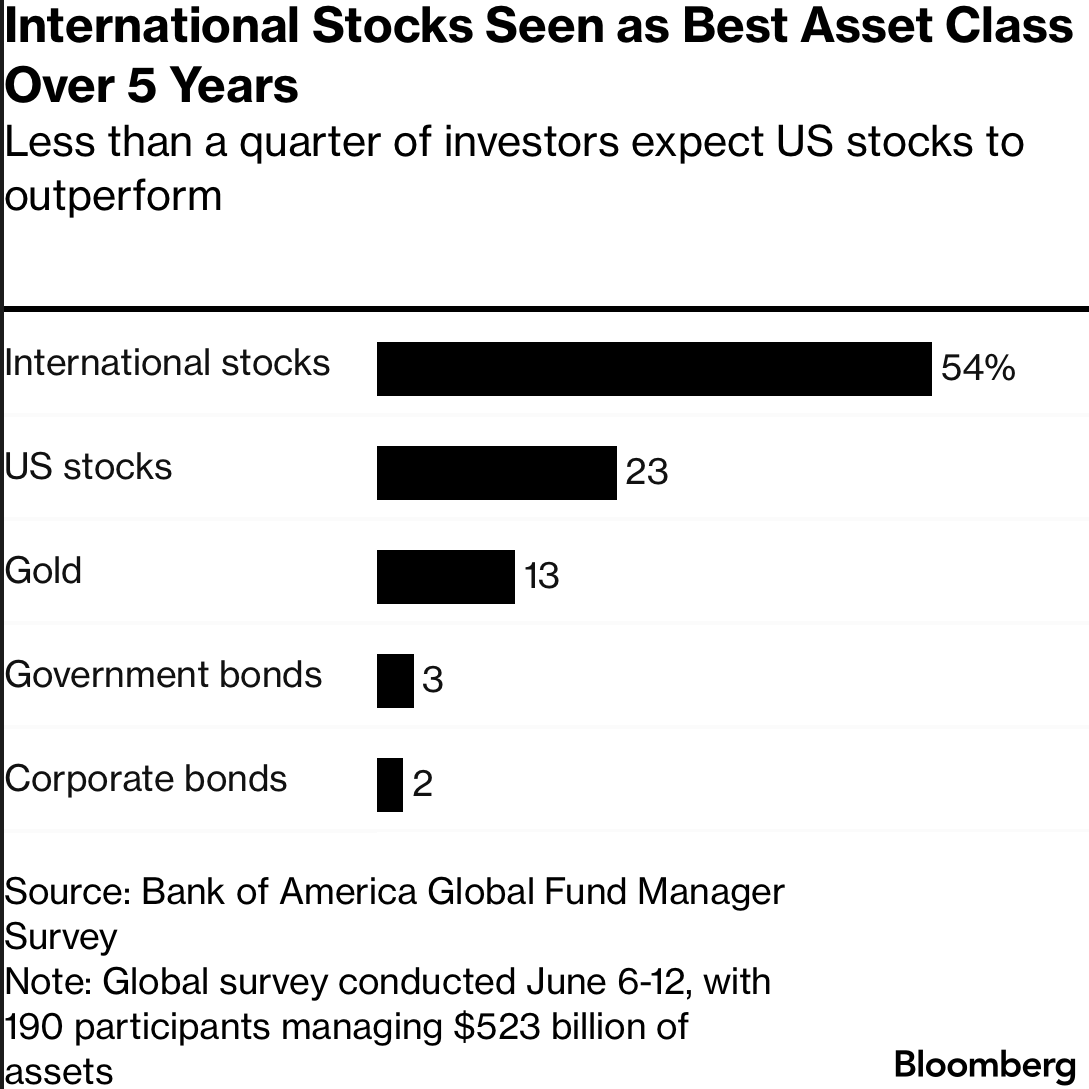

If everyone agrees on something, you should start getting nervous right?

That’s the mood around U.S. equities right now.

📉 According to BofA’s latest Global Fund Manager Survey, only 23% of managers expect U.S. stocks to be the best-performing asset class over the next 5 years.

🔮 Meanwhile, 54% are betting on international equities to take the crown.

It’s an interesting call.

But (not surprisingly) it comes right after one of the few years where international stocks are actually beating the U.S. The first time in decades.

So, you see the problem?

Narrative tends to follow price. Not the other way around.

The moment Europe and Japan start to outperform, the hot takes show up: “The U.S. is done!” “Valuations are too high!” “Japanese stocks are back!”

JPM expects Japan, EU, and China to outperform the US in the next 10-15 years

Good start.

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi)

11:30 AM • Jun 15, 2025

Maybe those calls are correct. I really don’t know. But neither do they 🤣

U.S. equities have outperformed international stocks in 13 of the last 15 years. Betting against them has not been a winning strategy.

The S&P 500 is up 24% from the April 7 low.

France is up 18% in the last 25 years.

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi)

3:23 PM • Jun 7, 2025

But since nobody knows, that’s why we diversify. Not because we know what will win, but because we don’t.

So while the “Sell America” trade is trending, don’t forget what usually drives long-term returns: innovation, capital efficiency, and a pro business environment which leads to higher corporate earnings.

Lastly, when looking at international stocks performance we cannot forget the role the USD has played. If you invest in an international equity ETF like IEFA, and the USD weakens compared to the currencies of the countries in the ETF, it will go up in value.

The US Dollar is worth 9.4% less than it was at the beginning of the year.

— Koyfin (@KoyfinCharts)

6:28 PM • Jun 16, 2025

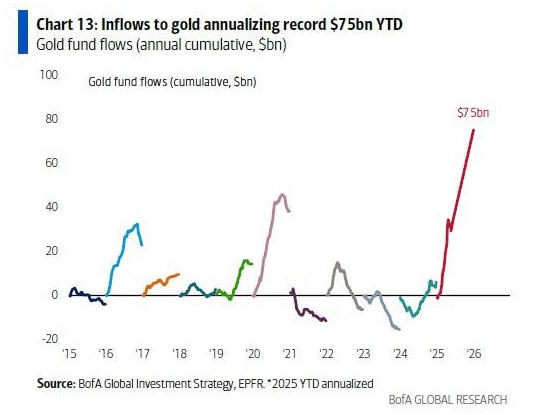

Gold Continues to Have It’s Moment

I’ve talked about gold before, plenty haha. Mostly as an interesting side story, not a headline.

But it’s hard to ignore what’s happening.

📈 ETF fund flows into gold are running at a record

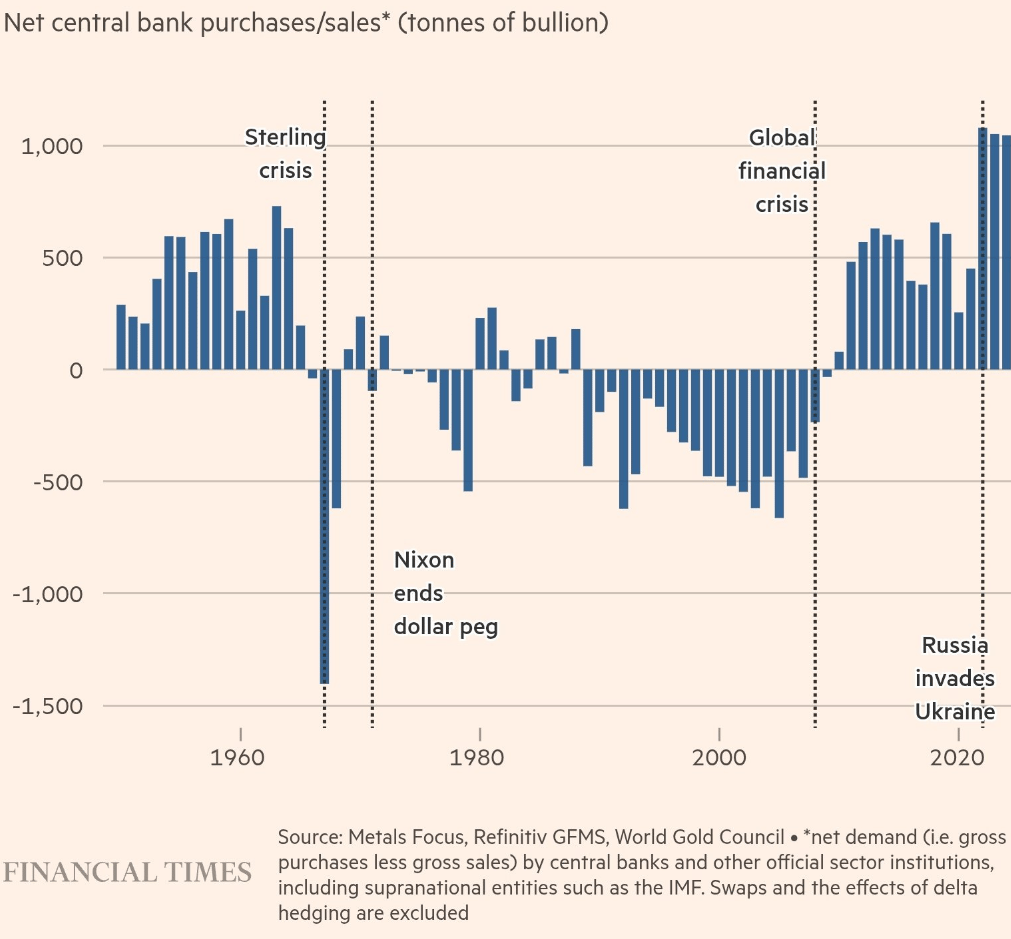

🏦 Central banks keep buying (even as the price has run up a lot), at levels not seen since the 1960s.

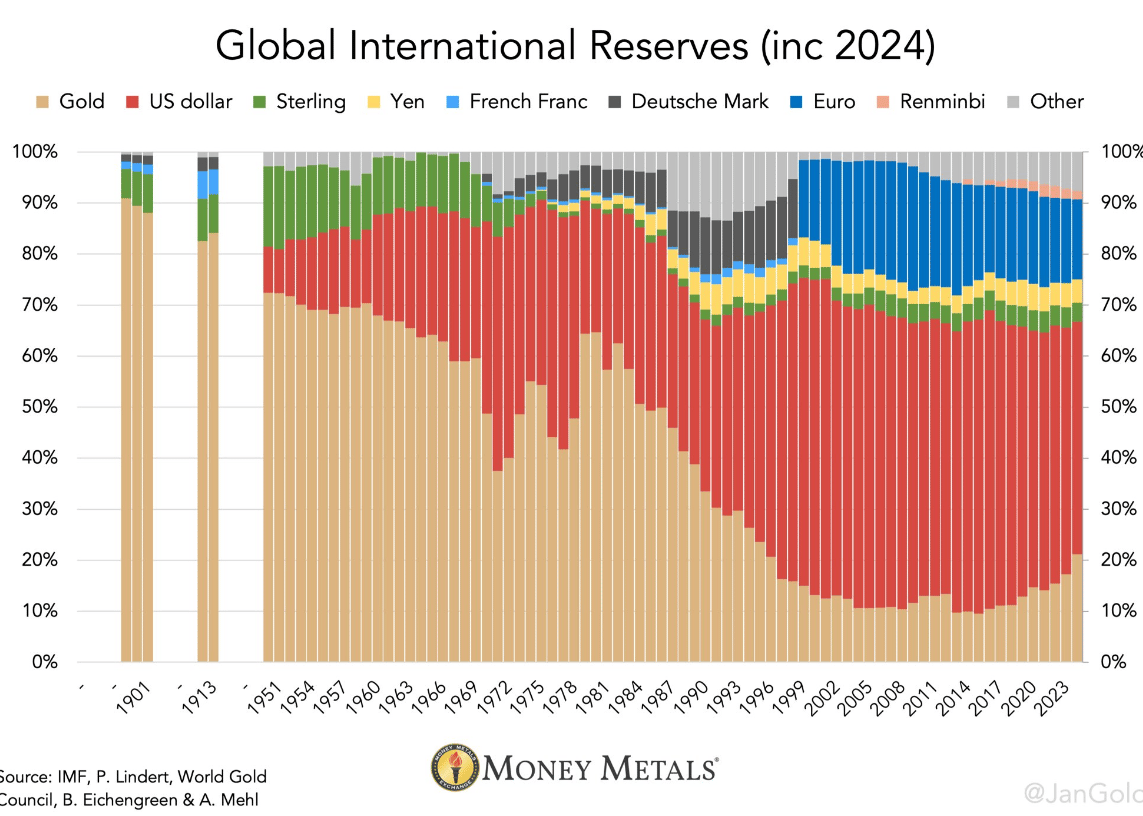

🌍 And gold’s share of global reserves is climbing, while the dollar is dropping.

None of this is new if you’ve been paying attention. What’s changed is that price is catching up to the narrative.

For the last decade, gold’s been dead money. Boomer bait.

Now? It’s become a consensus trade.

Not because people suddenly love it, but because more investors are realizing they don’t trust the USD as much and there are no other alternatives.

Imagine calling gold a “new” risk-free asset😅

*Gold IS THE risk-free asset instead of the dollar and Treasurys

— Taylor Kenney (@taylorkenneyitm)

1:41 PM • Jun 14, 2025

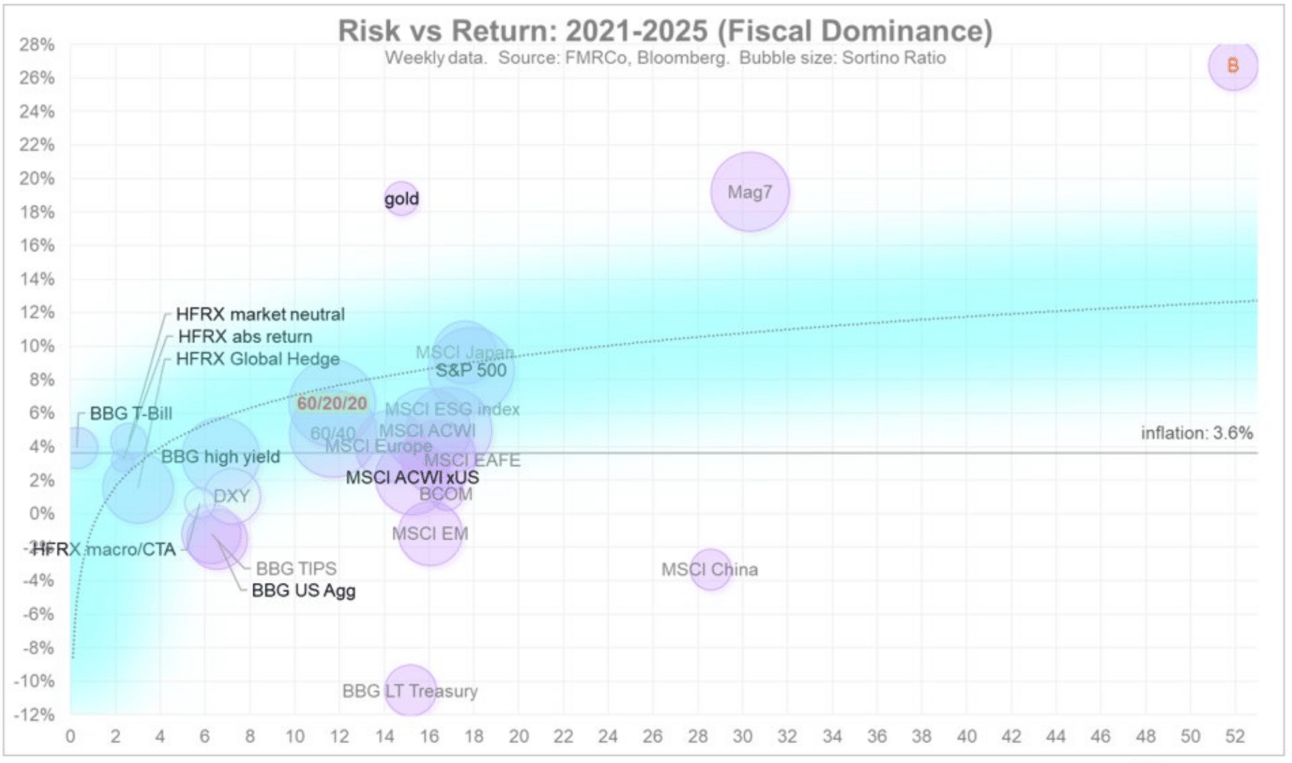

Looking at a chart of asset class returns over the past five years. Gold is standing out, along with the MAG 7 stocks and BTC 👀

Trump and Powell BFF-ing

The love relationship between Donald Trump and Federal Reserve Chairman Jerome Powell (who Trump appointed) continues to grow 🤣

Trump on his relationship with Jerome Powell…

Absolute comedy:

“He just refuses to lower rates. I don’t even think he’s political, I think he hates me. He probably should, I call him every name in the book to try and get him to cut.”

— Geiger Capital (@Geiger_Capital)

2:09 PM • Jun 18, 2025

Additionally Trump called Powell “a stupid person” and even floated appointing himself as “shadow Fed Chair” if Powell doesn’t play ball.

But, Powell is holding firm on rates, even under political heat.

• The Fed kept rates steady at 4.25–4.50%, pushing expected cuts out to September.

• Trump’s public pressure risks undermining Fed independence (and US capitalism as we know it).

In Powell’s defense, considering financial markets are not exactly struggling, maybe rates not going down is not so bad…

It is totally fine to not cut rates with absolute dogshit, zero-revenue companies worth $10B going up 10% every day, Chamath asking if he should launch another SPAC, low unemployment, markets near ATH, and an uncertainty machine in the White House

— BuccoCapital Bloke (@buccocapital)

8:18 PM • Jun 18, 2025

Unfortunately or fortunately, depending on where you stand on the issue, Powell’s mandate ends in May 2026 and naturally he won’t be reappointed for another term.

Markets are already pricing in a “yes” man will be appointed:

RECORD INTEREST RATE FUTURES TRADE 🚨🚨

Speculators just made the largest interest rate futures trade in history by betting that the Fed will become dovish immediately following Powell's 2026 exit

— Barchart (@Barchart)

1:30 AM • Jun 19, 2025

INTERESTING CHARTS of the week

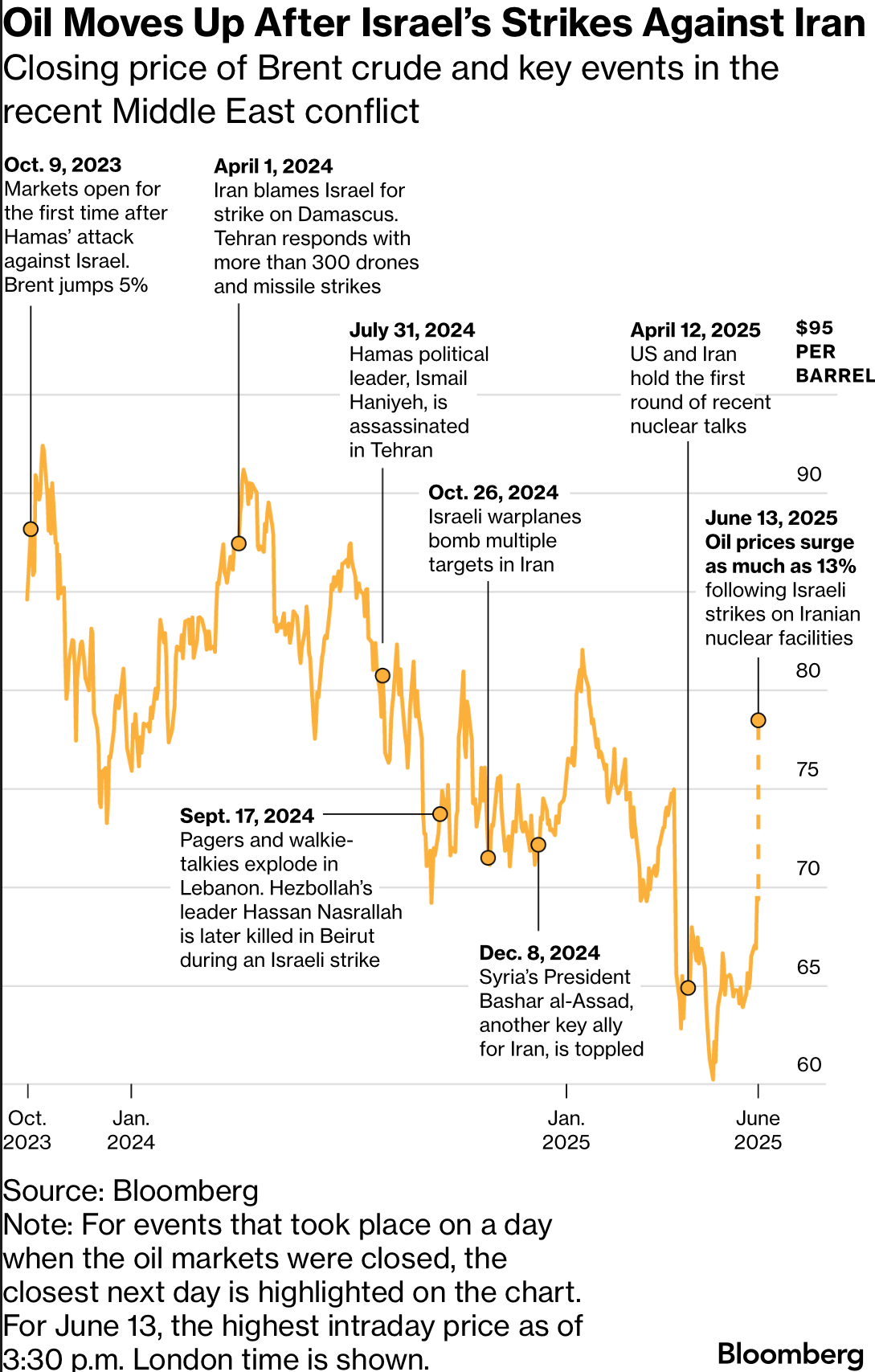

With the Israel-Iran war oil prices have suddenly revived. So far, oil production has not been interrupted (likely a Trump request on Israel) but the market is now pricing in a geopolitical risk premium again.

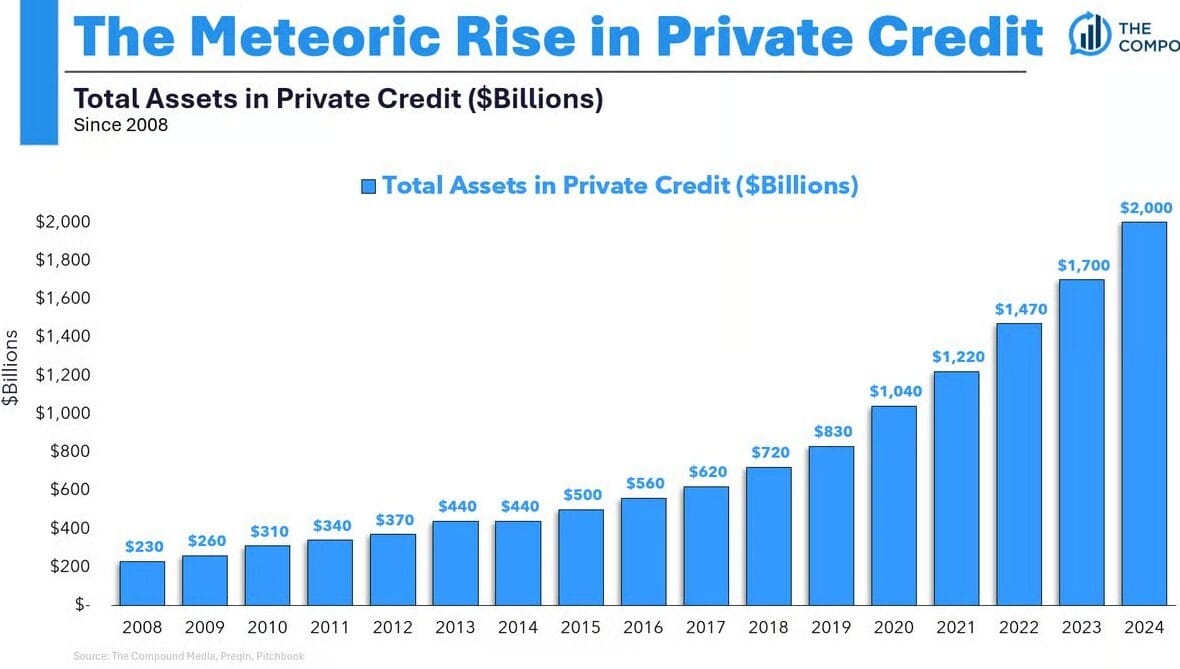

Private credit is booming. With banks pulling back and public markets offering less certainty, more capital is flowing into private deals, creating a surge in supply but also raising questions about return quality and deal discipline going forward.

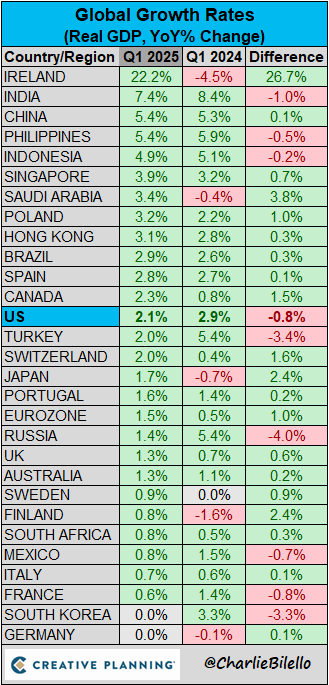

Lastly, take a look at GDP growth rates for different countries around the world year-over-year:

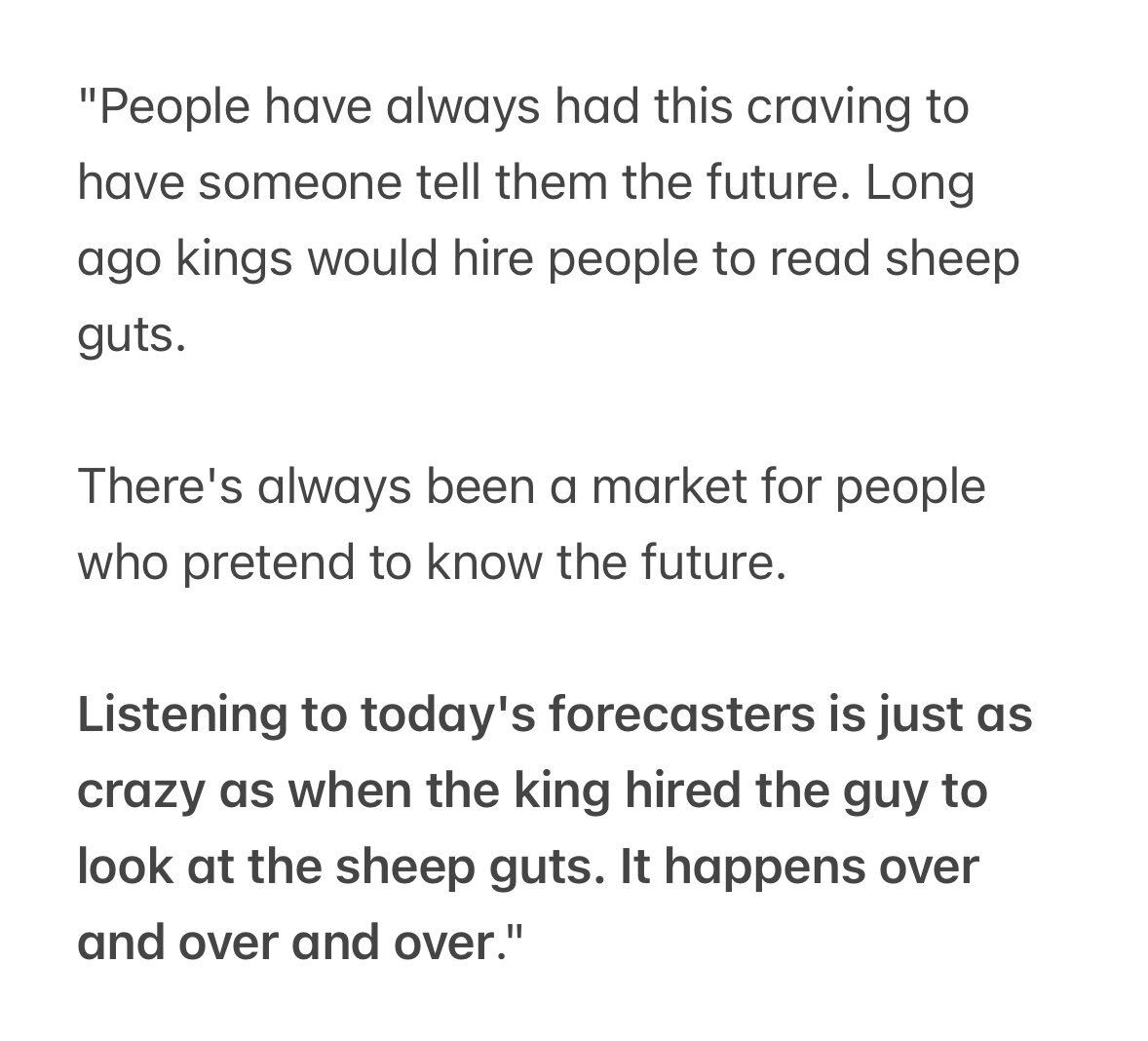

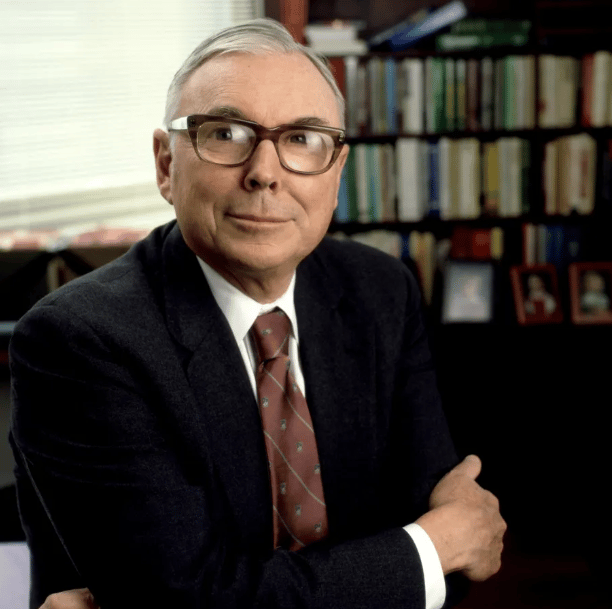

PARTING WISDOM

from CHARLIE MUNGER:

Charlie Munger (1924-2023) Vice Chairman Berkshire Hathaway

thanks for reading and have a great weekend,

Al Atencio

Receive the next article by subscribing below 👇🦉