- The Young Investor

- Posts

- The Worst is Still to Come

The Worst is Still to Come

What you should know about the markets

THE YOUNG INVESTOR

becoming a great investor one mistake a time

Welcome to This week’s edition of Market Bites

Grab a cup of coffee, get comfortable, and catch up on financial markets.

I’ve been doing the reading and scrolling, to bring you the most relevant updates.

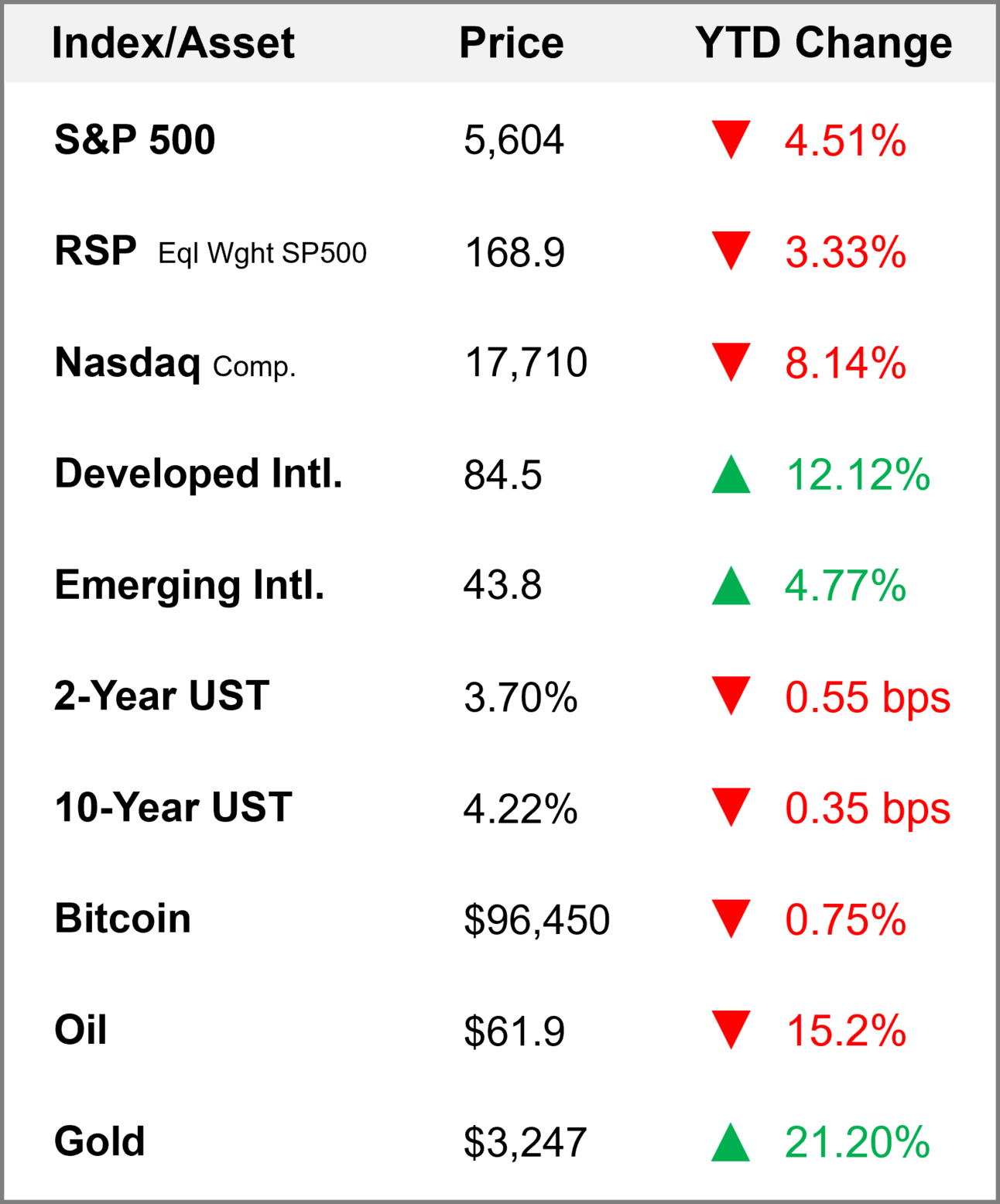

Before we dive-in, take a look at:

MARKETS YEAR-TO-DATE

The Sky Might be Falling (But Stocks Are Rising)

Markets just posted one of their best two-week runs since 2022, and yet, you wouldn’t know it from the tone of the financial commentary.

Strategists are still explaining the Tariff Liberation selloff. Investors remain on edge.

Podcasts warn of empty shelves and looming recession.

But market action is saying something different.

Stocks have quietly climbed back from the April lows, defying a wall of fear and doomer sentiment.

On Bloomberg, the headline reads: the S&P500 is headed for the best winning run since 2022.

In fact, the S&P500 recovered almost all the April losses:

The S&P 500 finished the month down 0.76% after seeing an 11.2% MTD drop on 4/8 and an 11.8% rally from that point through today's close.

This was the closest we've gotten to getting back to even in a month that saw a 10%+ drop since 1952 when the 5-day trading week began.

— Bespoke (@bespokeinvest)

9:25 PM • Apr 30, 2025

Kinda crazy, right.

There’s a disconnect, between vibes and price.

It’s the classic setup: fear gets priced in before reality hits.

By the time people capitulate emotionally, the market has already grinded back up, and many are not positioned for it.

Mixed Signals

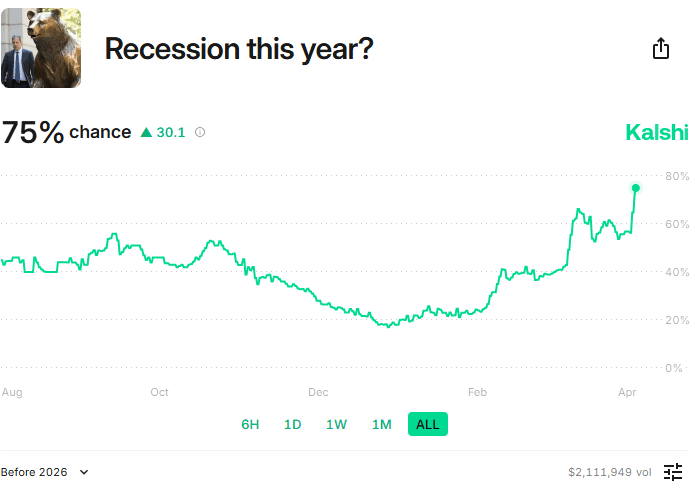

It might feel like we’re in a recession, but the data doesn’t quite agree.

Consumer confidence is down. Many CEOs are gloomy. Small business sentiment is in the gutter. The “vibes,” as they say, are bad.

And yet… retail sales are rising.

Payrolls keep growing. Credit card spending? Still firm.

Even the GDP contraction in Q1 (-0.3%) came alongside a 1.8% rise in consumer spending.

It’s the classic soft vs. hard data debate.

Neil Dutta from RenMac Researech calls this “data discontinuity.” Maybe consumers are pulling forward spending to stay ahead of tariffs or inflation.

Maybe it’s just lag?

Maybe this, maybe that 🤣 🤣

It’s not just economists scratching their heads, companies are sending mixed messages:

McDonald’s reported its biggest U.S. sales drop since 2020: 3.6% down in Q1, blaming consumer anxiety.

Hilton says travelers are entering a “wait-and-see mode”.

Booking Holdings noted higher-end consumers are still spending, while lower-tier demand is softening.

But at the same time:

American Express said April spending trends are holding steady across all segments and categories.

Capital One echoed the same: the consumer remains “a source of strength.”

Even JPMorgan Chase, looking at the lower-income segment, saw “no signs of distress”.

And companies like Meta and Alphabet are ramping up capex: pushing $70B+ each in 2025, mostly toward AI infrastructure.

So where does that leave us?

Markets are trying to figure out if we’re running on real strength… or just momentum borrowed from the future.

This debate is why Macro forecasting is a fools errand. I feel a headache just articulating the contradictory elements of everything that’s happening 🤣

Are We Buying the Dip… or Just Delaying the Pain?

The paradox: the economic outlook is uncertain. Sentiment is gloomy. And yet, retail investors are buying the dip, big time.

It feels like another vibecession, where vibes are bad, data is worse, yet asset prices refuse to crack.

It feels a bit like 2020. When COVID was crushing the economy, but markets bottomed in March and took off while the world was still locked indoors.

Why the déjà vu?

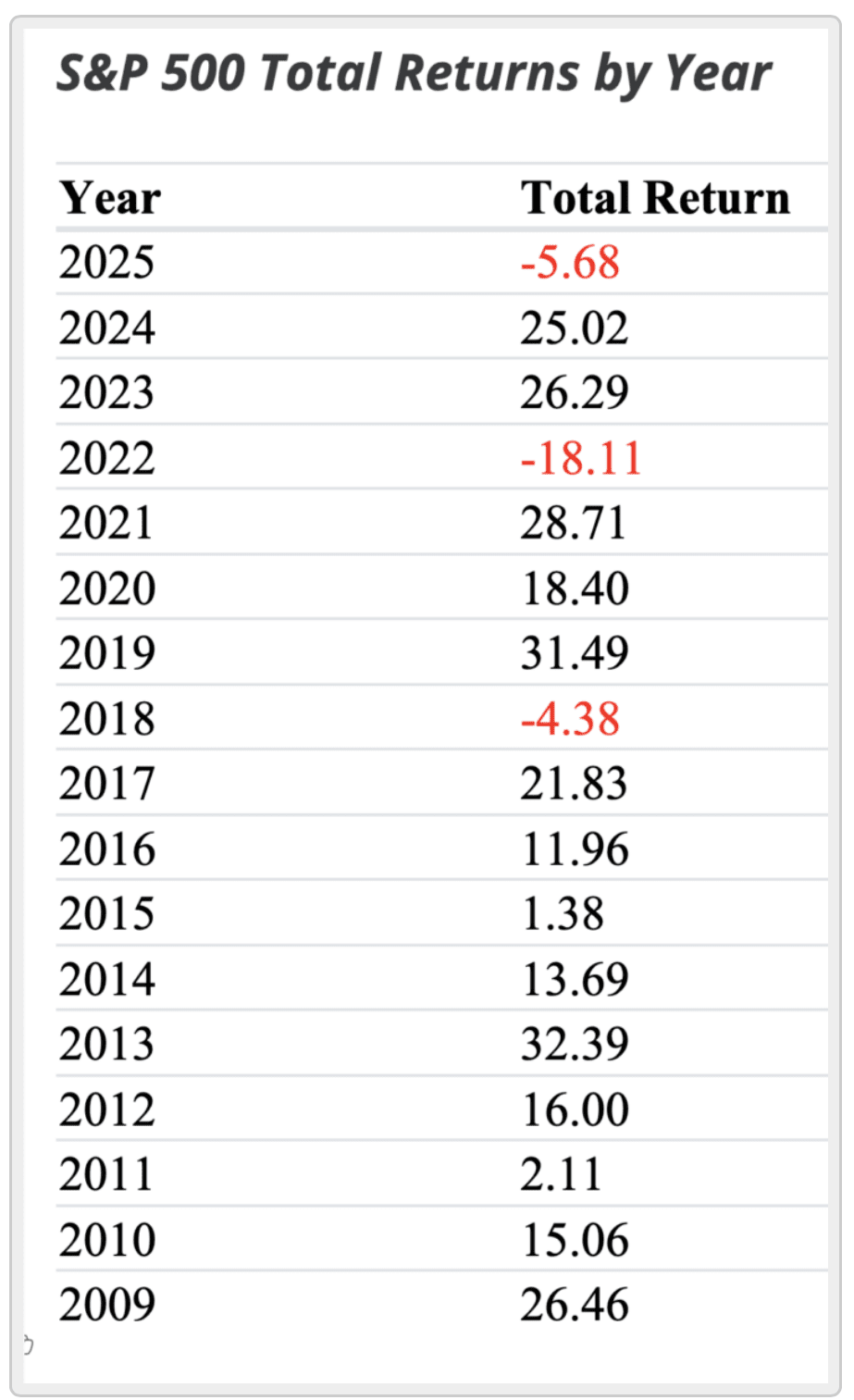

Investors have learned over the past 16 years to buy the dip. Every shock since 2008 has rewarded it, from the GFC to the pandemic:

So now, as another recession possibly happens (Q1 GDP was negative), investors are seeing through it.

Is that the right move?

It could be. Because markets are forward-looking: they reflect todays underlying fundamentals, and expectations of the future.

“The biggest mistake investors make is they invest in the present rather than forward looking and looking at where the puck is going instead of where the puck is.”

"You have to visualize the situation 18 months from now, and whatever that is, that's where the price will be, not where it is today. Never, ever invest in the present. It doesn't matter what a company's earning, what they have earned.”

So if we’re entering a slowdown or a shallow recession right now, that would imply markets are already looking at the recovery on the other side.

Maybe the stock market just priced in a recession and got over it in like 7 days and moved on

— Ben Carlson (@awealthofcs)

8:59 PM • Apr 30, 2025

But here’s what’s making me think twice.

This isn’t 2009. Or 2020.

No stimulus bazooka has been fired. The Fed isn’t cutting rates either or doing QE.

Going back to the highs implies Trump will fold on tariffs. Will he?

And what if the recession is worse than expected?

Then buying the dip may finally backfire.

Until we know, we are in a weird limbo, where both camps might be right:

The pessimists are correct about coming economic pain.

The optimists are right that markets look ahead.

We just don’t know which side has better priced in the facts and probabilities.

INTERESTING CHARTS of the week

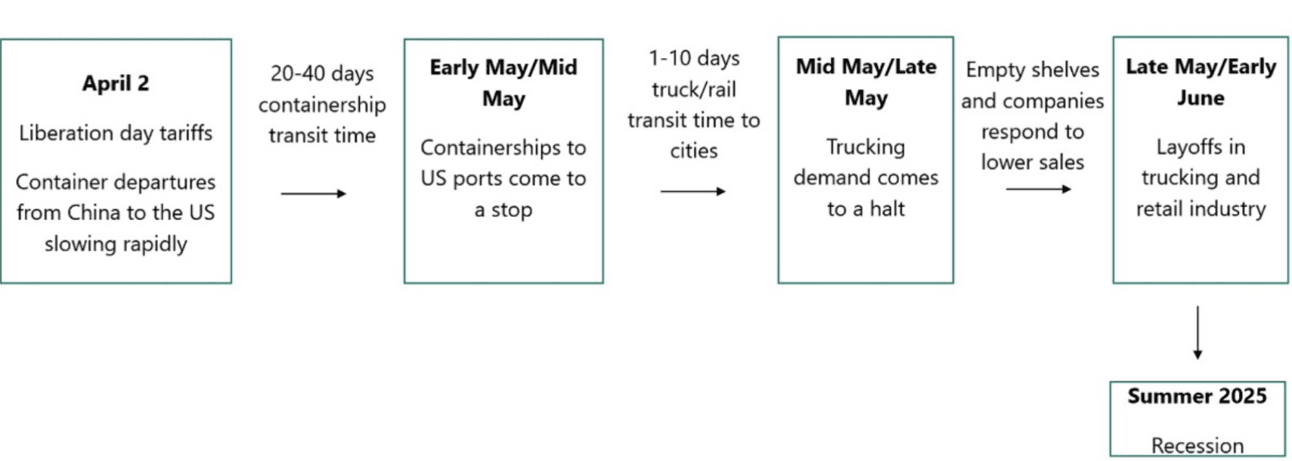

Check out a potential timeline of when tariffs are likely to hit the US economy:

Meanwhile, BTC is closing in on $100k again.

If the overall market rally is sustainable then it has a good chance of reaching this year’s original forecasts of $150k.

Hey @scottmelker

If Bitcoin can regain the broken parabolic slope then $BTC is on target to reach the bull market cycle top in the $125k to $150K level by Aug/Sep 2025, then a 50%+ correction— Peter Brandt (@PeterLBrandt)

1:03 PM • May 1, 2025

PARTING WISDOM

from JOHNNY CASH:

You have to be what you are.

Whatever you are, you gotta be it

The man behind the QUOTE → One of the real ones. He made music for the rebels. Raw, honest, and straight from the gut. No fluff. Just stories about pain, love, and getting through it. When you listen to Johnny’s music, you feel it, because he lived it

thanks for reading and have a great weekend,

Al Atencio

Receive the next article by subscribing below 👇🦉