- The Young Investor

- Posts

- Weekly Market Bites

Weekly Market Bites

financial news that makes sense

Welcome to your weekly market wrap-up.

Grab a cup of coffee, get comfortable, and catch up on financial markets.

I’ve been doing the reading and scrolling, to bring you the most relevant updates.

end of week markets update

1) This past week has been a good example of how quickly market sentiment can do a 180.

Just a week ago, everyone was freaking out about the “interest rate tantrum,” with 10-year yields creeping toward that “psychologically important” 5% mark. The vibe —> Bull market in trouble 📉

Then, boom, by Wednesday, December’s consumer price data came in softer than expected. Bond yields dropped all week, and just like that, the narrative flipped —>Bull market back on 📈

2) I love this tweet 🤣. What about you?

Hang it in the Louvre

— Aurelius (@Aureliusltd28)

1:42 PM • Jan 15, 2025

Amid the financial noise, it's worth remembering: long-term the S&P 500 has gone up because earnings have gone up. Not due to Fed balance sheets or liquidity magic.

For example, I remember Pre-COVID it was dogma that post-2008 stock market gains were almost purely due to the Fed’s zero interest rate policy and QE.

Yet here we are, after the Fed raised interest rates to two-decade highs and has done a ton of QT, and stocks are still hitting record highs.

What gives?

“Perspective: Hindsight Bias & Narrative Fallacy explains 90% of what you see/hear/read in financial punditry + market commentary.

Everybody can tell you exactly what just happened & why, but curiously, none seem to be able to predict what's about to happen next...”

“We seem to require a narrative to understand events even when those stories lead us astray.”

3) Revisiting last weeks debate on how expensive US stocks are:

While the S&P500 overall is valued at around 22 times earnings. The MAG-7 (Apple, Microsoft, Nvidia, etc.) stocks are in a league of their own at 31 times.

Why are they so expensive?

The graph below is a data point in the story, showing just how much more profitable today’s largest companies are compared to the past.

And intuitively we know this —> Apple and Nvidia are more profitable businesses than Procter & Gamble and GE were back in 2000s when they were in the top ten.

But.

The MAG-7 today are also deep into a massive AI capital investment phase.

The amount of capital these companies are pouring into AI chips, data centers, and related infrastructure rivals other major technological waves in history. Which didn’t all end up great for shareholders.

You want to know if US large cap stocks will continue to outperform in the next 5-10 years?

Tell me if they are going to make close to as much money on AI as their previous products…

4) While investors are worried about US bond yields rising - yields on Chinese bonds are crashing.

The yield on a Chinese 5-year or 10-year bond has gone from above 3% a couple of years ago to half that today.

Why?

People in China are worried about slow growth, falling prices, and a weak property market. So, instead of investing in riskier stuff like stocks or real estate or stocks, they're putting their money into these government bonds, which are seen as safer bets.

This is being compared to what happened in Japan during their "lost decades" of economic stagnation.

So, US bond yields are rising in part because of solid economic growth, inflation and government deficits. While the opposite is somewhat happening in China.

charts / graphs

~75% of the 50 most valuable companies in the world are American.

And only 3/18 in the $500+ Billion club are non-American.

This is a great way to visualize the results of the US stock market outperforming the rest of the world for the last fifteen years.

No signs of peak oil demand.

EIA (US Energy Information Agency) forecasts oil consumption growth this year’s at 1.3 million barrels per day, and next year’s growth at 1.1 million barrels per day

Both around the long-term annual growth average.

Same for coal and other fossil fuels whose demand continues to increase.

And you were told we are currently rapidly transitioning to renewables…

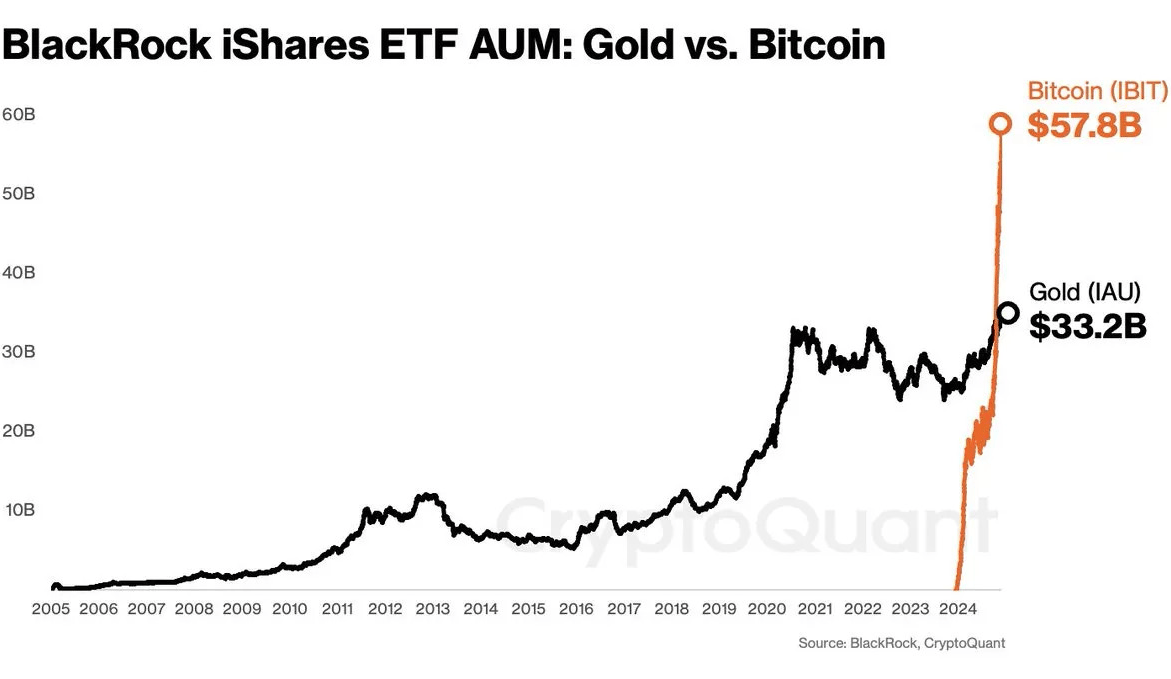

Blackrock’s 2024 Bitcoin ETF launch in perspective

It’s a lot of AUM. Long live Bitcoin 😂

And finally, some parting wisdom

thanks for reading and have a great weekend,

Al Atencio 🦉

Don’t to forget to share the young investor with your friends…

To receive the next article directly in your inbox, subscribe below 👇🦉