- The Young Investor

- Posts

- Weekly Market Bites

Weekly Market Bites

financial news that makes sense

Welcome to your weekly market wrap-up.

Grab a cup of coffee, get comfortable, and catch up on financial markets.

I’ve been doing the reading and scrolling, to bring you the most relevant updates.

end of week markets update

1) Here’s a summary of the markets year-to-date:

2) What a week.

The rollercoaster ride started even before Monday.

Some were already calling it "Black Monday 2.0" by Sunday night.

And while the week ended on a positive note, the markets delivered on the drama.

Volatility has not been this high since Covid and the Great Financial Crisis:

If you were following the markets and news and felt overwhelmed, take comfort in this:

Most financial commentators I follow seemed more hysterical.

(Still deciding if that’s a bullish or bearish signal.)

For example:

The legendary Howard Marks said:

“The chaos caused by tariffs is "probably the biggest change in the economic environment "I've seen in my career," marking the end of an 80-year period of unsurpassed prosperity driven by free trade.

The world was “shook up like a snow globe by the events of the last days" & "we know much less today than usual." Will the US still be the best place to invest?

"If people don’t like the dollar, don’t like investing in the US, don’t want to hold an unlimited number of treasuries; if we just make people mad, the fiscal situation will be very complicated.”

The two most bullish analysts on Wall Street capitulated:

Fundstrat’s Tom Lee:

Wedbush’s Dan Ives:

“These reciprocal tariffs (trade deficit converted into some odd calculation) implemented would cause an economic Armageddon and stop the US tech world in its tracks…

And wipe out a bright future ahead in one global policy mistake that will reverse US tech dominance in our view.

Stocks are getting crushed as investors know math and the reality.”

By midweek, it felt like full-on panic mode.

Alarm bells were going across many corners of the financial system.

And frankly, the data gave enough ammo for anyone who wanted to panic.

Via @5thrule, this is now 4 straight days where the S&P 500 had a trading range greater than 5%.

The only other times this has happened were 1987, 2008, and 2020.

— Joe Weisenthal (@TheStalwart)

7:25 PM • Apr 8, 2025

Crude Oil fell 13.6% on Thursday-Friday of last week, one of the biggest 2-day declines in history.

In the past, big short-term declines have often coincided w/ recessions (1990-91, 2020, 2008-09) as investors anticipated a collapse in demand.

The exceptions: 1986, 2021, 2022.

— Charlie Bilello (@charliebilello)

2:46 PM • Apr 6, 2025

Particularly worrying was the combination of:

A crashing stock market (yes, we lived through an actual crash)

A falling dollar (usually a safe-haven trade in crises)

And rising long-term bond yields (which usually fall when things get bad)

The three above were indicating that something was off:

Something has broken tonight in the bond market. We are seeing a disorderly liquidation.

If I had to GUESS, the basis trade is in full unwind.

Since Friday's close to now ... the 30-year yield is up 56 bps, in three trading days.

The last time this yield rose this much in 3

— Jim Bianco (@biancoresearch)

4:10 AM • Apr 9, 2025

The vibes from the "market pros" were basically:

and this 🤣

Then as well know, Trump announced a 90-day pause on Wednesday.

Leading to a 9.5% rally in the S&P500.

The best day for stocks since 2008.

15 minutes before making his announcement, Trump posted this on his social media account:

What can I say my friends…

3) How to panic markets and alienate capital…

The U.S. sits at the center of global capital markets. And capital today moves fast.

Right now, markets are speaking.

And I think this captures the vibe:

“We basically told the whole world that they had been cheating us for years. That Europe was only set up to screw us. That people should pay a fee to use the US $$.

Why is it irrational for those countries to sell the $$ and sell our bonds? And stocks.

The whole world is overweight US assets. Even lightening 20 percent could be called prudent risk management.

We have risked safe haven status for the first time in my 35 years in markets. We haven’t lost it but we have put it at risk.

Don’t believe me, just look at the gold chart.”

He’s right, look at Gold 👀

Gold hit a new record high today.

A true safe haven asset.

— Brew Markets (@brewmarkets)

8:36 PM • Apr 10, 2025

And the Swiss franc:

Swiss Franc – a true safe haven #currency – seems poised to break out to an all time high versus the #USD.

— Richard Bernstein Advisors (@RBAdvisors)

2:55 PM • Apr 11, 2025

4) What are possible scenarios for the S&P500?

It’s gonna come down to how all this affects:

Corporate earnings (EPS) and

Valuations (P/E multiple)

As you can see by the chart below from Goldman Sachs there are a wide range of outcomes:

Since the 90-day tariff pause, the S&P has ranged between 5,000 and 5,350. Not yet low enough to place it under the “Recession Scenario” column according to the chart above.

This range suggests the market right now is expecting a slowdown in earnings growth and valuations have taken a hit.

Is a recession priced in or not?

That’s a big part of the tension right now.

5) The stock market is not obvious…

A lot of people I talked to this week are convinced the worst is still ahead.

The logic goes: tariffs just dropped, the real economy hasn’t felt the hit yet, and Trump could tweet us into chaos any minute now.

The seers at Goldman Sachs updated their base case to a recession this week… and then walked it back 73 minutes later.

Not 73 hours. Seventy. Three. Minutes.

Goldman Sachs’ research department publishing these two headlines 73 minutes apart lmao

— litquidity (@litcapital)

6:56 PM • Apr 9, 2025

So yeah, nobody knows wtf is going to happen.

And most of us are bracing for more bad news. And we may even be right.

But Josh Brown (CEO at Ritholtz Wealth) wrote a post yesterday that’s worth your time. It tackled this simple but tough question:

“Why would I buy stocks before a recession?”

The answer: Because the stock market is forward-looking. It almost always recovers before the economy does.

Just look at the COVID crash in 2020:

Markets bottomed long before earnings turned around:

Source: Ritholtz Wealth Management

or GDP growth:

Source: Ritholtz Wealth Management

So trying to time the market based on what feels like is coming next is not a great move.

This is something I struggle with a lot myself.

But I try to remind myself of the following, to avoid being impulsive:

I can’t time the market (because almost no one can)

If everyone’s panicking, it’s probably a terrible time to sell (it almost always is)

I’m mostly fully invested in a globally diversified portfolio (Not all-in USA)

I’ve got some cash on the side, and if things get uglier, I’ll deploy it

charts

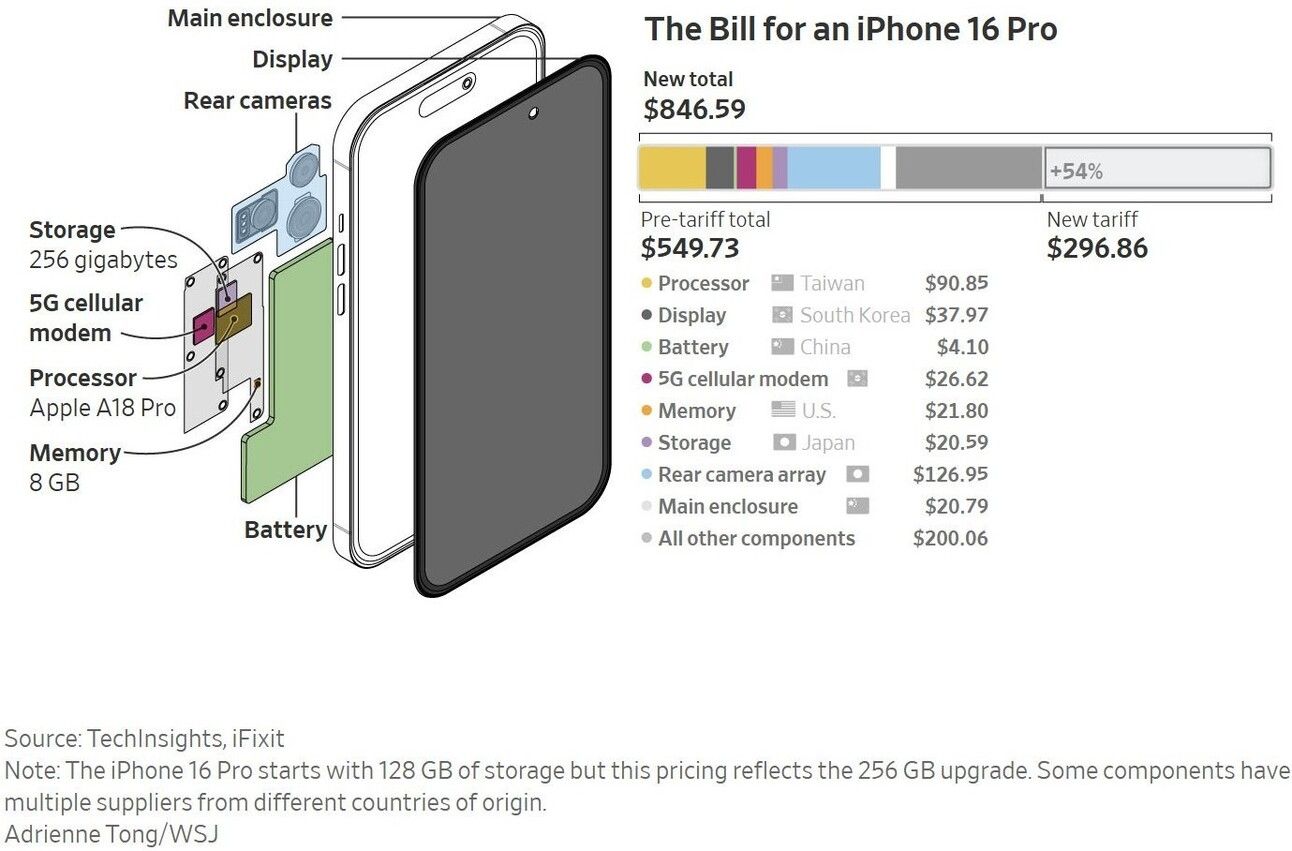

How much does an iPhone cost to make? And how much will tariffs raise the price?

What happened to the good old days?

A quick look at the countries America does the most trade with:

Clearly the most important countries / regions are:

North America: Canada and Mexico

Europe: EU

Asia: China, followed by Japan, S. Korea and Vietnam

Trade deals with these countries are the ones that really matter.

And finally, some parting wisdom

thanks for reading and have a great weekend,

Al Atencio 🦉

Don’t to forget to share the young investor with your friends…

To receive the next article directly in your inbox, subscribe below 👇🦉