- The Young Investor

- Posts

- Weekly Market Bites

Weekly Market Bites

the financial news you need

Welcome to your weekly market wrap-up.

The weekend is almost here, so grab a cup of coffee, get comfortable, and catch up on financial markets.

I’ve been doing the reading and scrolling, to bring you the most relevant bites.

end of week markets update

1) This week’s main market news was a prediction by Goldman Sachs strategists calling for a lost decade in the S&P500.

One thing’s for sure—it was a brilliant piece of marketing.

It was bear porn, drawing in all those convinced the market is: overpriced, overextended, inflated, manipulated, you name it.

It pissed-off all the bulls, who think market predictions are worth less than toilet paper, remember past forecasts (which all missed), and include the tech believers, optimists, and so on.

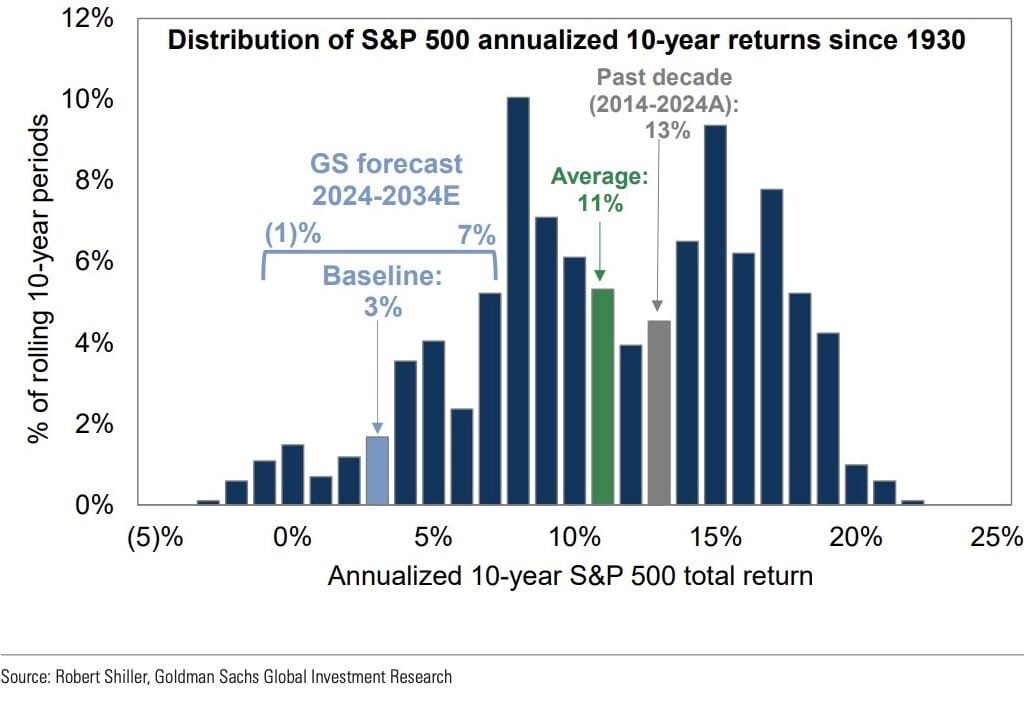

Putting this in context, the S&P500 has had decade-long annualized returns of 3% or lower only three times in the last 100 years:

The Great Depression, the stagflation of the 1970s, and the Great Financial Crisis.

Lets try to chew threw this in today’s bites.

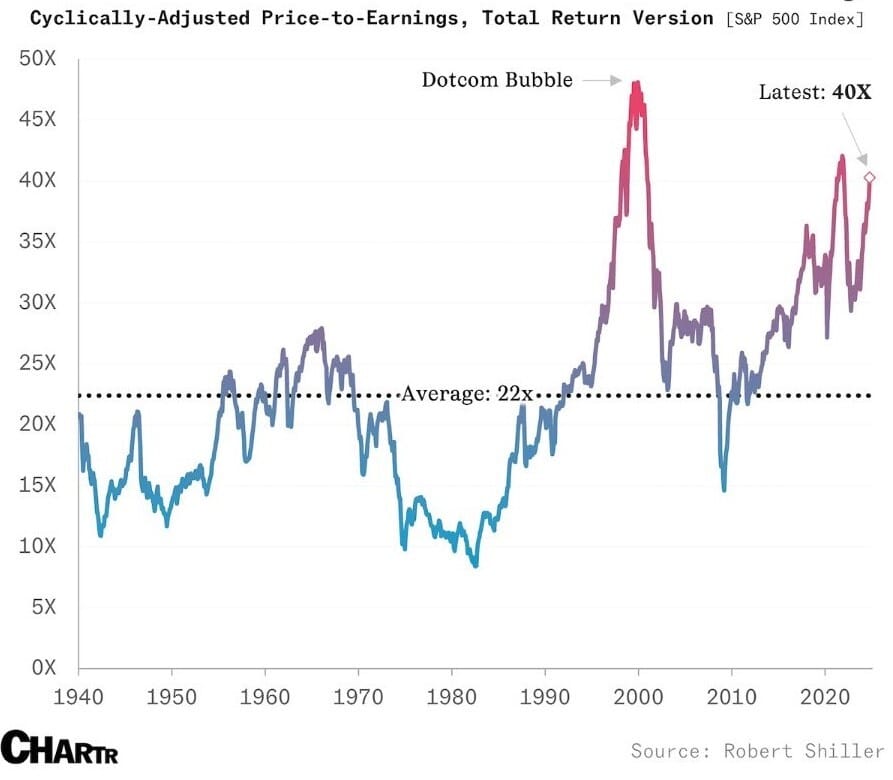

2) Goldman Sachs, along with the bears, argue that U.S. equities are very expensive compared to history.

Their metric to measure this? The Cyclically Adjusted Price-to-Earnings ratio (CAPE) ratio.

The CAPE ratio measures how expensive/ cheap stocks are relative to their earnings. But instead of using just one year of earnings like a regular P/E ratio, it uses the average earnings from the past 10 years.

And YES, the US stock market today looks expensive compared to history.

The question for investors is who is right:

Bears: Mean reversion.

Bulls: This time is different (the most dangerous 4 letter phrase in investing).

3) Lets hear the reactions from some of best people out there:

Jawad Mian over at Stray Reflections went one step further saying Goldman’s prediction was too optimistic.

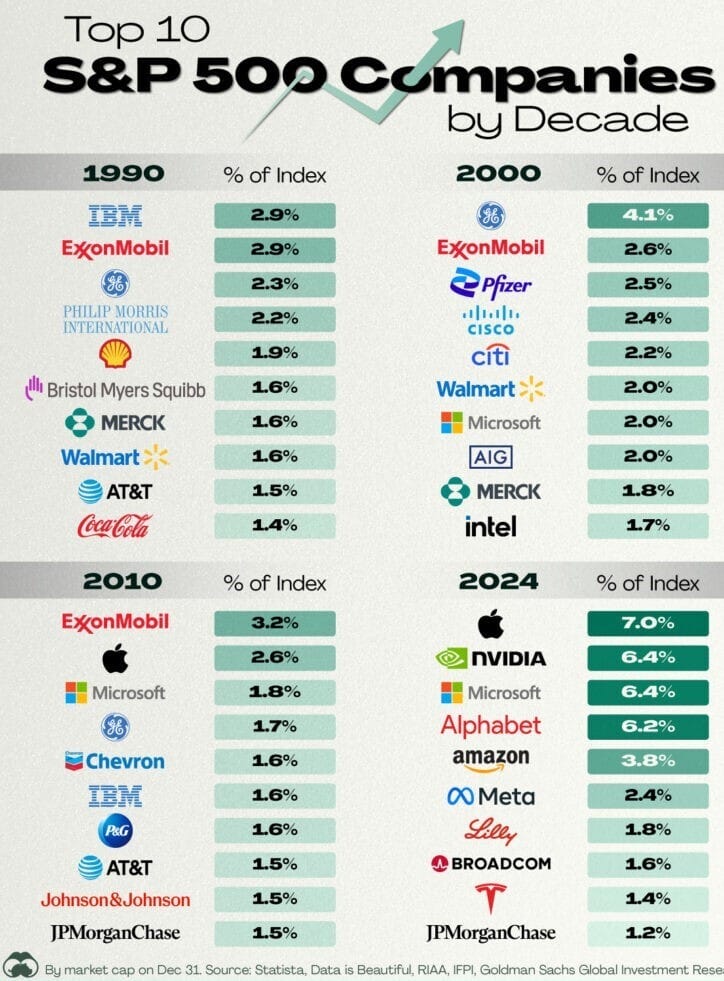

Warren Pies at 3F Research released a great report arguing that while equities may seem expensive, stocks are actually fairly valued.

Why? Today’s S&P 500 companies are higher quality and more durable than those from 20 years ago, let alone earlier.

New 3FR report out to clients. In this edition:

-We re-examine our assumption that the market is wildly overvalued.

-Consider what the massive shift from cyclical to growth sectors implies for valuations (i.e. how do higher margins impact multiples across different businesses).— 3Fourteen Research (@3F_Research)

9:31 PM • Oct 16, 2024

And our market Rabbi, Barry Ritholtz, over at The Big Picture, while more of an optimist, reminded us that a lot of these predictions are BS:

“I have no idea what the next decade will bring in terms of S&P500 returns, but neither does anyone else. I do believe that the economic gains we are going to see in technology justify higher market prices. I just don’t know how much higher; my sneaking suspicion is one percent real returns over the next 10 years is way too conservative.

We are all better off if we admit that guessing returns over the next 10 or 20 years is a fool’s errand.”

4) The 10-year treasury rate has gone up from 3.6% to ~4.25% since the Fed cut interest rates a few weeks back. Not great.

Check out the interesting take below:

BONDS

Many are misinterpreting recent price action. The move (from 3.6 to 4.25) in the 10-yr (post-Fed cut) does not signal a policy mistake.

Instead, it is the unwind of "recession insurance" buyers.

Conclusions from the 9/19 @3F_Research report below:

— Warren Pies (@WarrenPies)

2:13 PM • Oct 23, 2024

5) And lastly, gold continues its unstoppable historic run.

Gold hit an all-time high today for the 4th day in a row. Now on pace for its best year since 1979 with a gain of 33% YTD.

bilello.blog/newsletter

— Charlie Bilello (@charliebilello)

4:05 AM • Oct 23, 2024

charts

Talking about today’s S&P500 versus the past, take a look at this chart:

Source: The Visual Capitalist

What do you think? Should today’s top companies trade with the same P/E as ExxonMobil, IBM, Phillip Morris, Shell, AT&T did 20-30 years ago?

And finally, some parting wisdom

On a personal note,

This week, I lost someone who was like family—one of my dad’s best friends. He was a man who helped instill in me from an early age one of the greatest lessons of life - how much friendships matter. Because the people we choose to share our lives with make all the difference. True friends give life its meaning.

“Friendship is the greatest of worldly goods. Certainly to me it is the chief happiness of life.”

“Friendship is unnecessary, like philosophy, like art.... It has no survival value; rather it is one of those things which give value to survival”.

thanks for reading and have a great weekend,

Al Atencio 🦉

Don’t to forget to share the young investor with your friends…

To receive the next article directly in your inbox, subscribe below 👇🦉